Long-term financial sustainability : an evaluation methodology with threats considerations

47-69 p.

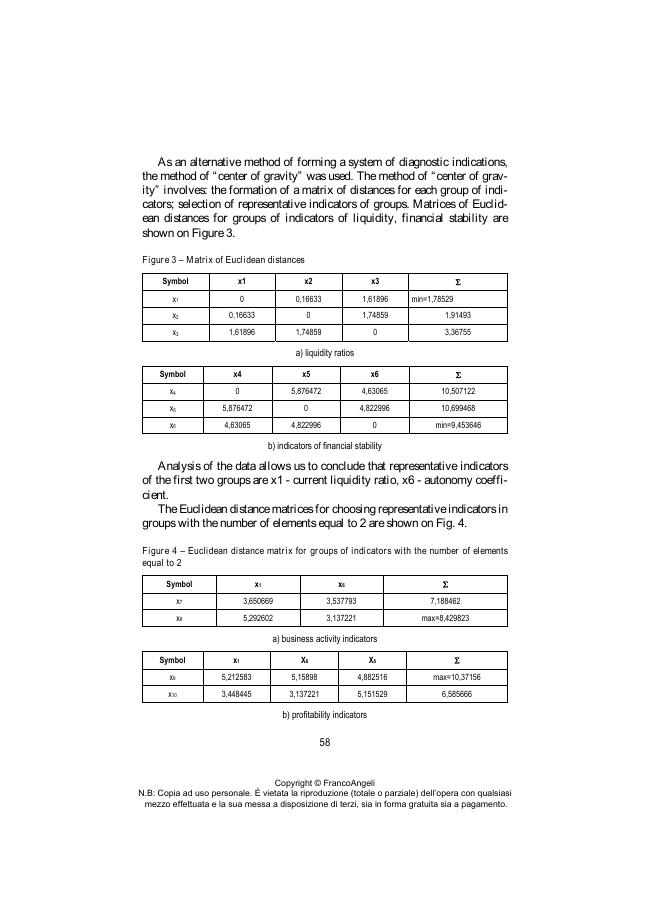

It is shown that one of the directions for increasing the efficiency of managing corporate systems (CS) under the influence of a large number of destabilizing fa-tors ("shocks", threats) is the development of a set of models of estimation and analysis of the long-term stability of CS in proactive contour of management, which allow timely diagnosing a decrease in the company's security level and adopting effective preventive management decisions. A review of existing approa-ches to the formation of such a set of models showed a number of limitations, the result of which is a low forecasting accuracy. The proposed approach, unlike the existing ones, allows to: 1) determine the optimal dimension of the information space of diagnostic factors; 2) find the optimal number of classes of situations for which differentiated management strategies can be developed; 3) determine the period of pre-emption, which does not require updating the models of retrospective diagnostics.

This makes it possible to identify the class of not only current, but also forecast situations for a given horizon of proactive management and to choose an adequate preventive strategy. [Publisher's text].

Forma parte de

Rivista di studi sulla sostenibilità : X, 1, 2020-

Artículos del mismo número (disponibles individualmente)

-

Información

Código DOI: 10.3280/RISS2020-001004

ISSN: 2239-1959

KEYWORDS

- Corporate system, evaluation, long-term financial stability, methods of business analytics of multidimensional processes, modelling, proactive management