Accounting discretion in family firms : the case of goodwill write-off : evidence from US firms

5-28 p.

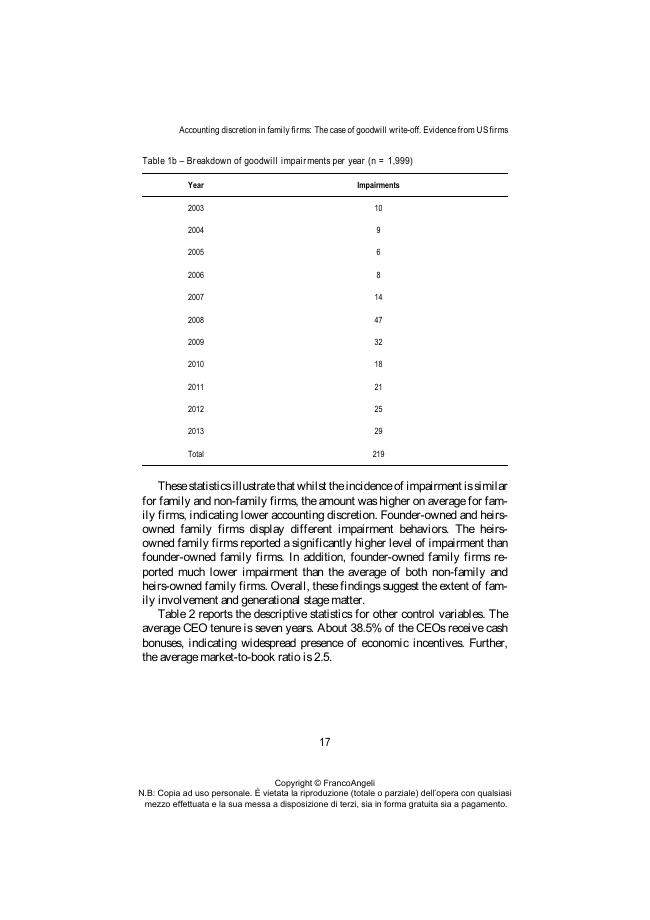

This paper investigates whether family ownership affects decisions to take a writeoff of the goodwill and the amount written off. This study is based on a panel of public United States firms. Consistent with predictions based on agency theory and socioemotional wealth (SEW) theory, the findings demonstrate accounting discretion in goodwill impairment is lower in family firms than nonfamily firms. The results also show that firstgeneration family firms are more likely to exploit accounting discretion in goodwill impairment decisions than second or later generation family firms, due to greater concerns associated with the negative consequences of the writeoff. This paper contributes to previous research on accounting in the context of family firms. Family firms cannot be considered a homogeneous group with the same propensity to exploit the discretion allowed by accounting rules in highly subjective fair value measurements.

Generational change significantly influences firms' accounting choices, leading to more credible earnings and asset values for second or later generation family firms. This study also suggests the earnings management literature would benefit from additional indepth investigation into how the generational stage of family businesses affects accounting discretion. [Publisher's text].

-

Artículos del mismo número (disponibles individualmente)

-

-

Información

Código DOI: 10.3280/FR2021-001001

ISSN: 2036-6779

KEYWORDS

- Agency theory, family ownership, goodwill, impairment, socio-emotional wealth