Portfolio stability ensuring : an emerging chaos case (on the example of Ukrainian agroholdings)

65-91 p.

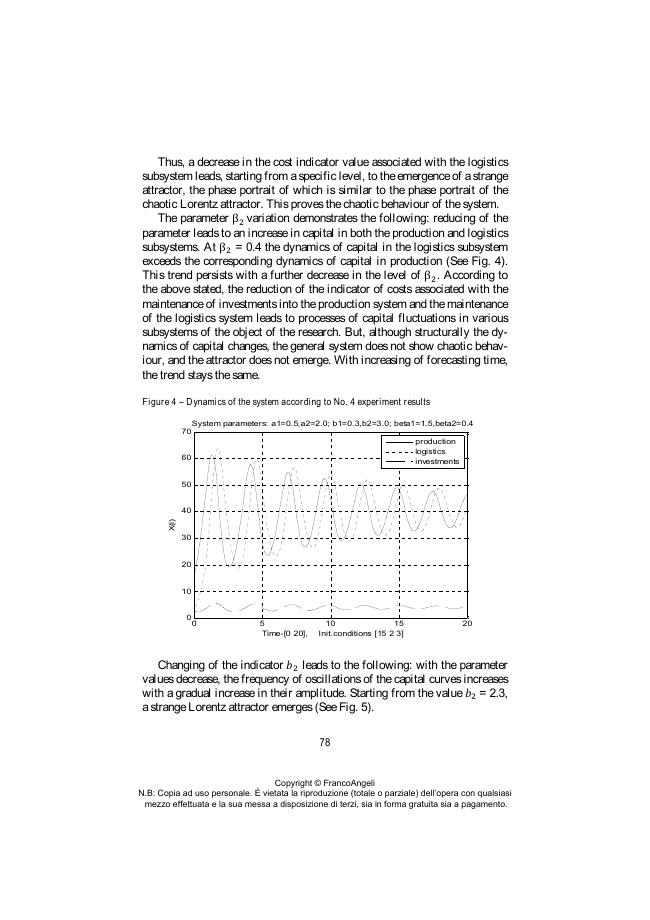

The purpose of this article is the study of large companies' investment activities on the example of agricultural holdings in Ukraine. The belonging of the studied objects to the complex dissipative economic systems with the emerging chaotic behaviour is proved. The conditions and measures of ensuring the balance of the company's investment portfolio are studied. The involvement of chaos theory is proposed as a mathematical basis of the studies. The proposed model of agroholding investment activity dynamics is presented by the system of differential equations and realized using the MatLab software platform. Numerical modelling of the investment processes dynamics in accordance with different values of management parameters is carried out. Transition scenarios of the system to a chaotic motion mode with the emergence of a strange Lorentz attractor are forecast.

Scenarios of experiments on the model in order to ensure sustainable proportional development of production and logistics subsystems of the agricultural holding and the formation of its investment portfolio are proposed. The behaviour diagnostics system model on the basis of evolutionary equations is aimed at increasing the efficiency of making corrective investment decisions for the sustainable development of the agricultural holding. [Publisher's text].

Fait partie de

Rivista di studi sulla sostenibilità : XI, 1, 2021-

Articles du même numéro (disponibles individuellement)

-

Informations

Code DOI : 10.3280/RISS2021-001005

ISSN: 2239-1959

KEYWORDS

- agroholding, dissipative system, production subsystem, logistics, investment activity, chaos theory, sustainable development